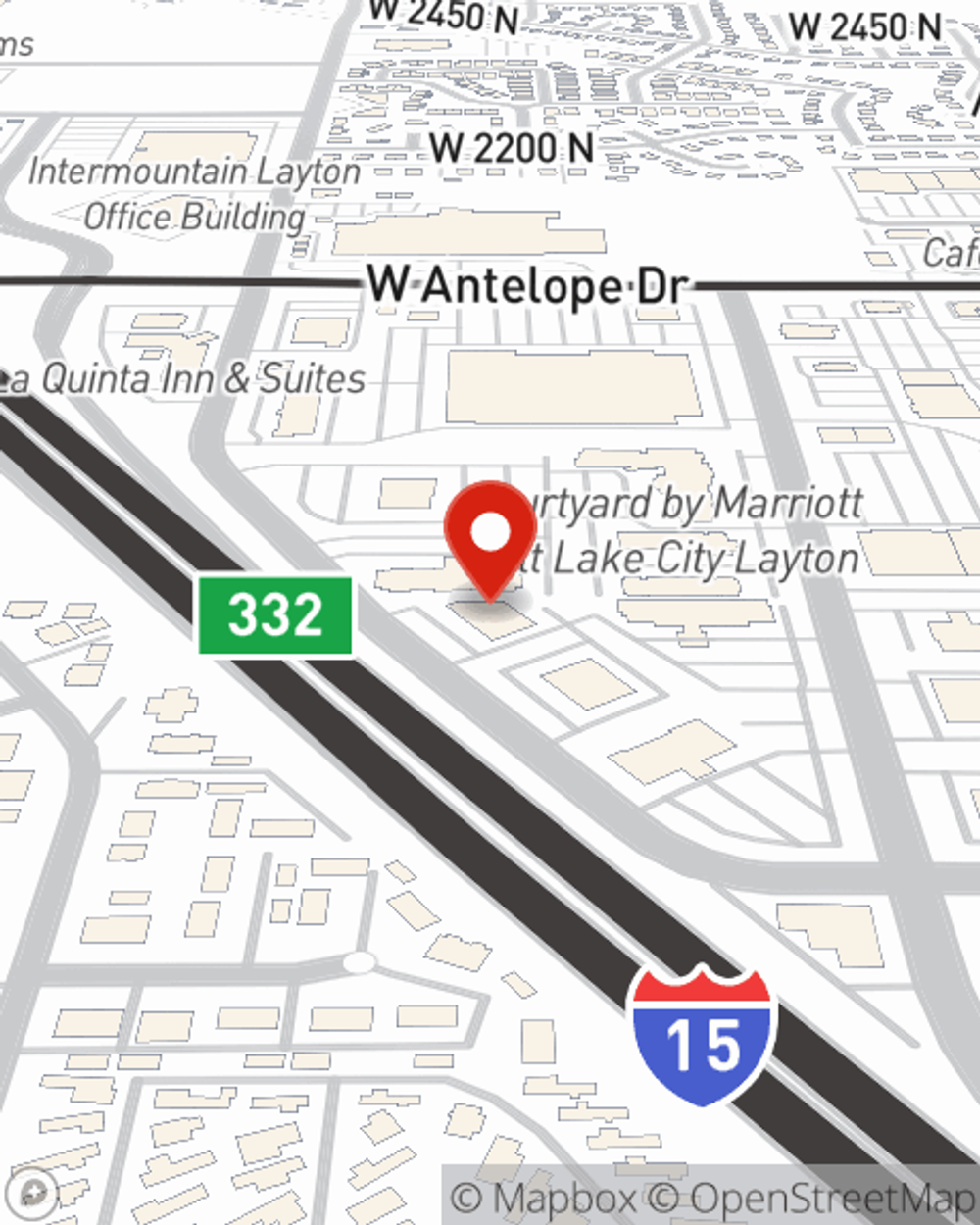

Homeowners Insurance in and around Layton

Protect what's important from unplanned events.

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Would you like to create a personalized homeowners quote?

- Layton

- Clearfield

- Kaysville

- Davis County

- Farmington

- Bountiful

- Roy

- Weber County

- Clinton

- Fruit Heights

Home Sweet Home Starts With State Farm

Your house isn't a home unless your protected with State Farm. This great, secure homeowners insurance will help you protect what you value most.

Protect what's important from unplanned events.

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

State Farm Can Cover Your Home, Too

You’ll get that and more with State Farm homeowner’s insurance. State Farm has coverage options to keep your largest asset safe. You’ll get a policy that’s adjusted to match your specific needs. Fortunately you won’t have to figure that out alone. With true commitment and fantastic customer service, Agent Richard Dunkley can walk you through every step to develop a policy that guards your home and everything you’ve invested in.

Having remarkable homeowners insurance can be significant to have for when the unexpected occurs. Reach out to agent Richard Dunkley's office today to get the home coverage you need.

Have More Questions About Homeowners Insurance?

Call Richard at (801) 773-3121 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

The pros and cons of paying off a mortgage early

The pros and cons of paying off a mortgage early

If you have extra funds, you may think about paying off a mortgage early. But review some key questions before you make that payment.

Richard Dunkley

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

The pros and cons of paying off a mortgage early

The pros and cons of paying off a mortgage early

If you have extra funds, you may think about paying off a mortgage early. But review some key questions before you make that payment.